- OpsFlow Newsletter

- Posts

- How to automate due date tracking in mortgage operations using Operational Analytics

How to automate due date tracking in mortgage operations using Operational Analytics

Keep loan files on track without stress and spreadsheets

Hey there,

Welcome to the new subscribers who joined last week.

Let’s talk about Operational Analytics.

In this issue, I’ll share how Operational Analytics can be applied to mortgage operations to automate the due-date tracking process.

Mortgage is one of the few industries where blowing the due date can cost a company a 5-figure loss.

So, ensuring that nothing falls behind is a crucial part of efficient mortgage operations.

This issue consists of the 3 parts:

My analysis of why improving due date tracking even matters

What’s Operational Analytics

How to use Operational Analytics for due-date tracking

I hope it will give you insight into how you can use Operational Analytics to automate the due date tracking process and gauge if it can benefit your mortgage operations.

Why automating due date tracking in mortgage operations even matter

Before trying to automate any process, it’s a good idea to clarify:

What exactly process you’re trying to automate

Why does this process even matter

What’s the current solution for getting it done

What are the limitations of the current solution

Below, you can find my analysis to answer these questions.

What process are we trying to improve

Mortgage lenders have quite a few due dates to meet throughout the loan origination lifecycle.

These dues dates usually come from:

Compliance requirements (TRID)

Borrower’s needs (Offer to Purchase)

Internal standards (Operations Manual)

Here are a few examples of the dates:

Initial loan estimate

Loan estimate redisclosure

Appraisal contingency expiration

Financing contingency expiration

ICDs

Loan decision

Closing

Rate lock expiration

Loan sale

etc

And for each due date, the process of tracking comes down to:

Calculating and capturing due date.

Retrieving and analyzing due dates.

Sending alerts when approaching the due date.

Why tracking due dates in mortgage operations matter

Because there are more due dates than a single person can remember.

And when mortgage lenders miss due dates, bad things happen.

For instance:

If a loan estimate is not re-disclosed on time → Lender eats a difference

If a loan is not sold on time → Lender burns money on credit line interest

If loan commitment is not delivered on time → Lender sabotages a deal

If an appraisal is not delivered within appraisal contingency → Lender pisses off a borrower

So missed due dates lead to:

Immediate financial losses

Negative experience for borrowers

Damage to company reputation

Negative word of mouth

Loss of referral business

Regulatory penalties

The current solution for tracking due dates in mortgage operations

From my research, the old way of staying on top of due dates looks like this:

Loan Officers and the Operations Team manually calculate due dates

Then, capture these due dates in spreadsheets, LOS, and Calendars

Individuals regularly check in with these due dates

The operations manager checks in with the due dates

When something falls behind, the Ops manager sends an email follow-up

Individual team members often have their own way of tracking due dates in addition to the one set by the company.

What are current due date tracking solution limitations

The solution's most significant limitation is that it relies on manual entry.

As a result, it is highly prone to human error:

Due date capture relies on manual entry → Easy to make a mistake

Due dates spread across multiple systems → Hard to get the complete picture

Alerts require manual work → Easy to forget or make mistakes

Highly dependent on individuals → Disaster if someone is OOO

Quickly becomes out of date → Easy to miss something

The odds of human error might not be significant enough to bother about them at a smaller volume.

But the more loans in the pipeline, the higher the chances of something slipping through the cracks.

What are the current due date tracking solution costs

I don’t see direct costs associated with the current solution as it relies on existing tools like LOS or free ones like Google Calendar and Spreadsheets.

But some indirect costs come from the manual nature of the solution:

Attention: Needs constant attention of the Ops manager to keep records up-to-date

Time: Manual capture, update, and alerts all require time

Flexibility: Less flexibility with taking time OOO because of the lack of a single source of truth

Stress: Lack of visibility may cause stress

What’s operational mortgage analytics

Operational analytics is a branch of business analytics that focuses on the optimization of the day-to-day operations of the company.

Traditional analytics is about analyzing a broader set of historical data to understand past performance and plan future strategies. While operational analytics is about using real-time data for optimization of current operations.

Operational mortgage analytics focuses explicitly on the optimization of mortgage company operations.

Operational mortgage analytics consists of 3 building blocks:

💾 Data

📊 Reporting

⚙️ Automation

💾 Data

Real-time data is the foundation for Reporting and Automation.

Usually, the data for operational mortgage analytics is in the shape of:

Entities (e.g., Loan, Borrower, etc)

Events (e.g., Application taken, Rate locked, etc)

Data is the result of the Data creation process.

Data creation is the process of gathering data from existing sources like LOS, POS, etc.

Then, it is cleaned, enriched, and transformed to be usable for Reporting and Automation.

📊 Reporting

Reporting enables you to get answers to questions such as:

Which applications have rate locks expiring next week?

What is the most time-consuming milestone?

On average, how often does [Individual/Team X] submit files for underwriting?

And it lets you get them fast.

Reporting is the result of the Data visualization.

Data visualization is the process of creating a visual representation of data.

⚙️ Automation

Automation lets you operationalize processes, reduce human error, and free up the team’s time.

A few examples of Automation:

When the rate lock expires → Send an email notification to an LO

If a a Loan commitment is due in 4 days → Send an SMS reminder to an LO

When Application is taken → Set a task in LOS

Automation is the result of the Data Activation.

Data activation is the process of Automation of actions based on real-time data.

How to use operational mortgage analytics to track due dates in mortgage operations

Automate due date capture based on real-time loan activity

With operational analytics, you can automatically calculate due dates and capture them based on the changes in your LOS or other system.

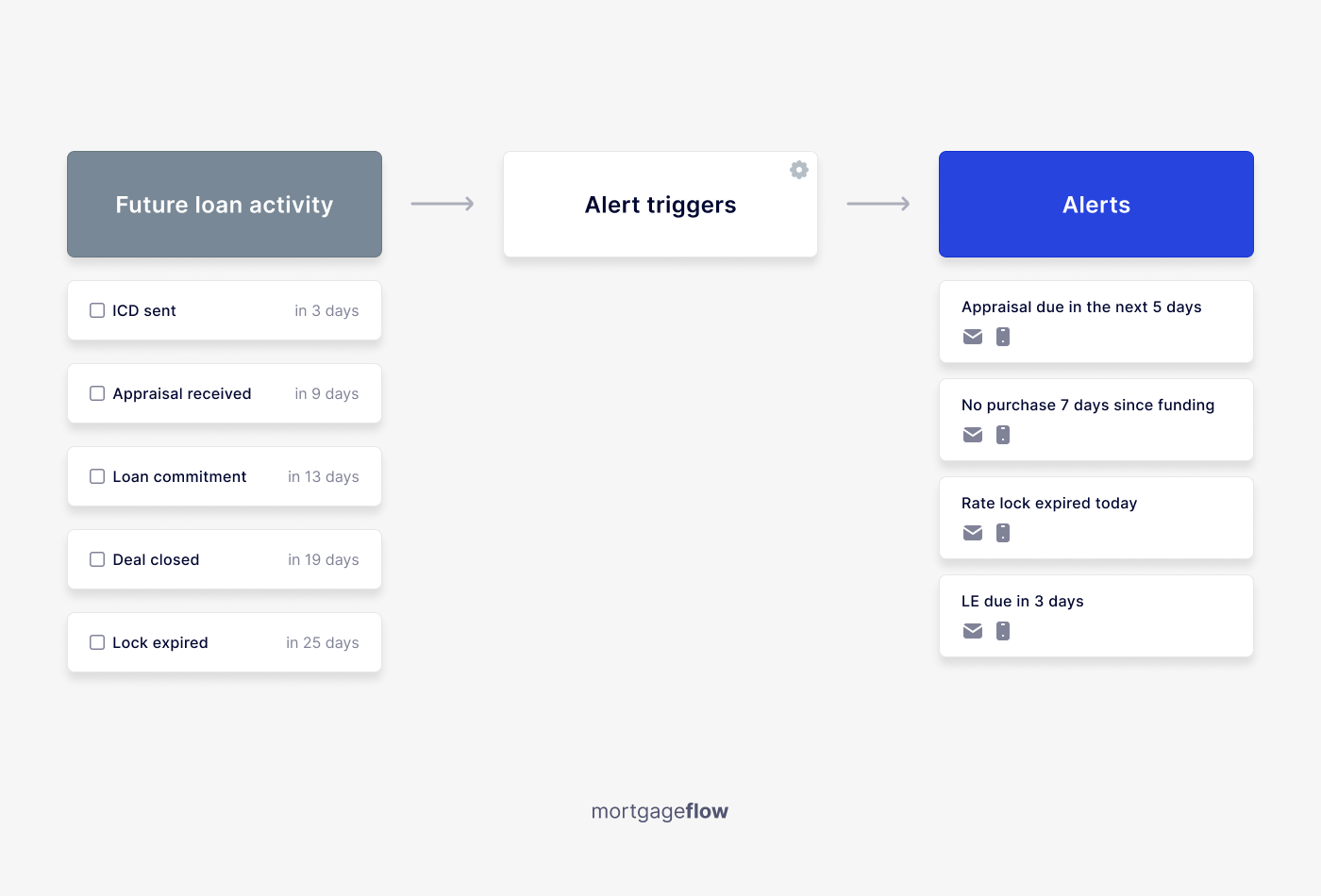

It relies on automated future activity capture, where, based on the real-time loan activity, you generate new activities that should happen in the future.

For example, you can capture due dates (future activities) based on the real-time loan activity like:

Application Taken → Loan decision

Rate Locked → Loan estimate redisclosure

Offer Accepted → Loan Commitment

And then automate the calculation of their due date based on the:

Triggering activity date (e.g., a date when an offer was accepted)

Activity and loan properties (e.g., financing contingency days)

Day of the week due dates fall on (e.g., whether it’s a holiday or not)

Automated future activity capture can reliably generate a feed of the due dates that you can later use for reporting and automation.

Set up real-time due dates reports

You can set up reports based on the auto-generated feed of the due dates (future activities).

These reports can give you a quick overview of where each loan stands in the pipeline and if any action is required.

For instance, you can use these reports to answer questions like:

What loans have rate lock expiring next week?

What due dates are due within the next 3 days?

What due dates does [Loan Officer X] have in the next 10 days?

You can visualize your due-dates reports as a timeline or table for easier comprehension. Here are a few examples below.

Timeline view:

Table view (example 1):

Table view (example 2):

You can use a combination of filters like the ones below to get as granular as you need:

Due date type (activity type)

Loan Commitment

Loan Estimate

Closing Date

etc.

Loan properties

Loan Officer

Type of loan

etc

How far into the future

Indefinitely

Next 3 days

Next week

Next 10 days

etc.

Send automated alerts based on due dates

You can configure automated EMAIL or SMS notifications about approaching due dates based on the auto-generated feed of future activities.

It relies on the concept of the alerts that can be triggered when certain conditions are met, for example:

5 days before a Rate Lock Expires

3 days before Loan Commitment Due

etc

You can even trigger alerts based on the days since activity has happened to send alerts for things without set-in-stone due dates but need timely action.

For example, trigger an alert when a Loan was funded but wasn’t sold within 7 days.

Once alert triggers are configured, they listen to the live event feed, and when conditions are met, they trigger an alert.

Then, you can use alerts to trigger automation that sends SMS or EMAIL using any workflow automation tool like Zapier.

Provide everyone with a single source of truth

Since due dates are automatically captured and reconciled, you have a single place with always up-to-date information about due dates.

So even if someone is OOO, you still can easily retrieve their due dates and continue work without disruptions.

I hope this post gave you insight into how Operational Analytics can be used to automate due-date tracking in mortgage operations.